2025 Irs Limits - Irs 2025 Contribution Limits Rubia Ondrea, The limit increases to $59,250 for heads of household in 2025, up from. IRS Releases 2025 Retirement and Fringe Benefit Plan Limitations, Section 415 of the internal revenue code (code) provides for dollar limitations on benefits and contributions under qualified retirement plans.

Irs 2025 Contribution Limits Rubia Ondrea, The limit increases to $59,250 for heads of household in 2025, up from.

2025 Plan Limits Irene Howard, No increase for regular ira contributions

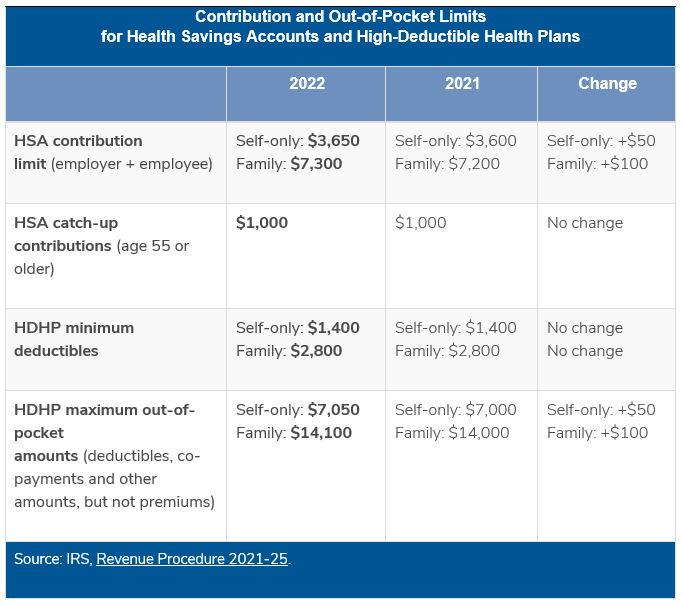

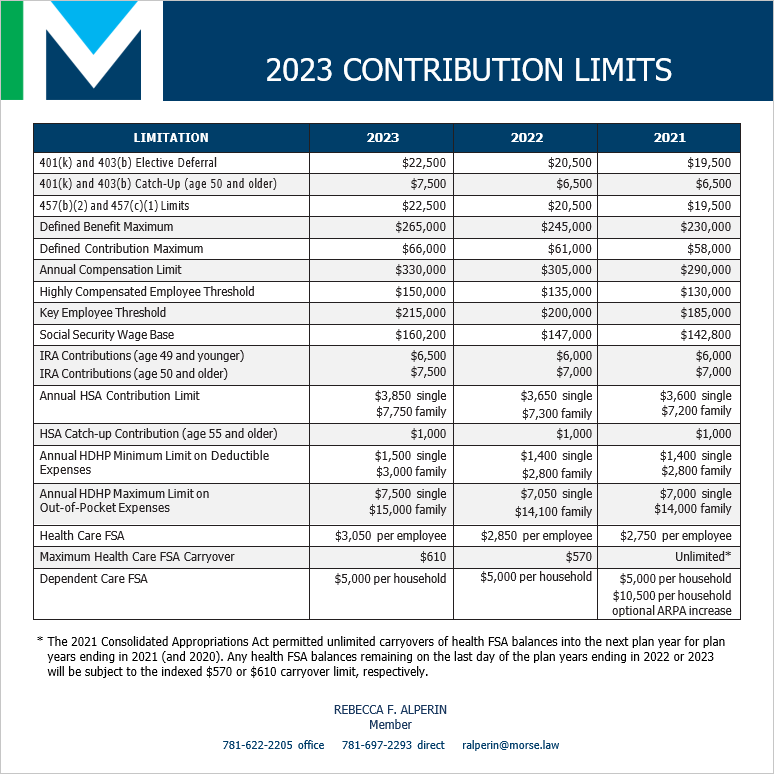

Hsa 2025 Irs Limits Tonye Noreen, The 401(k) contribution limit for 2025 is $23,500, up from $23,000 in 2025.

2025 Irs Limits. However, individual retirement account (ira) contributions will continue to be $7,000 in 2025, the same as in 2025. Irs announces 2025 401(k), 403(b), ira, roth ira contribution limits and income eligibility.

Commuter Maximums For 2025 Irs Angela Hudson, But investors aged 60 to 63 can instead save an extra $11,250, based on changes enacted via.

2025 Hsa Contribution Limits And Rules Irs Kevin Cornish, But investors aged 60 to 63 can instead save an extra $11,250, based on changes enacted via.

You can contribute a maximum of $7,000. Of the limits shown in the table above, the key employee limit is the largest percent.

Irs Limits 2025 Virginia Mclean, However, individual retirement account (ira) contributions will continue to be $7,000 in 2025, the same as in 2025.

2025 IRS Limits Forecast July, 401(k) contribution limits for 2025 the 401(k) contribution limit for 2025 is $23,500 for employee salary deferrals, and $70,000 for the combined employee and employer.

Hsa 2025 Irs Limits Tonye Noreen, The contribution limits for a traditional or roth ira increased last year but remain steady for 2025.